A pivot point is a specialized examination marker, or calculations, used to decide the general pattern of the market throughout various time periods. The pivot point itself is basically the normal of the intraday high and low, and the end cost from the past trading day.

On the ensuing day, trading over the pivot point is remembered to show continuous bullish opinion, while trading beneath the pivot point demonstrates bearish feeling.

The pivot point is the reason for the marker, however it likewise incorporates other help and obstruction levels that are projected in view of the pivot point computation. This large number of levels assist merchants with seeing where the cost could encounter backing or opposition.

Additionally, assuming the cost travels through these levels it tells the merchant the cost is moving like that.

The accompanying pivot point trading strategy has been around for quite a while. It was initially utilized by floor dealers.

This was a quite simple way for floor brokers to have a thought of where the market was going throughout the day utilizing only a couple of fundamental calculations.

The pivot point is characterized as the level at which the market heading changes for the afternoon. Utilizing some straightforward math and the earlier day's high, low and shutting costs, a progression of points are set.

These points can be basic help and opposition levels. The pivot level, backing and obstruction levels determined from those costs are altogether known as pivot levels.

Consistently, the market you are following has an open, high, low and shutting cost for the afternoon (a few business sectors, for example, the forex market, are open 24 hours, however we by and large use 12 PM GMT (Greenwich Mean Time) as the open and close time).

This data essentially contains every one of the information you really want to utilize pivot points.

The explanation pivot points tradingare so well known is that they are prescient rather than slacking. You utilize the earlier day's data to ascertain potential defining moments for the day you are going to exchange (present day).

Since numerous brokers follow pivot points, you will frequently find that the market responds at these levels. This offers you a chance to exchange.

As an option in contrast to working out pivot points all alone, you can utilize our own special pivot point adding machine.

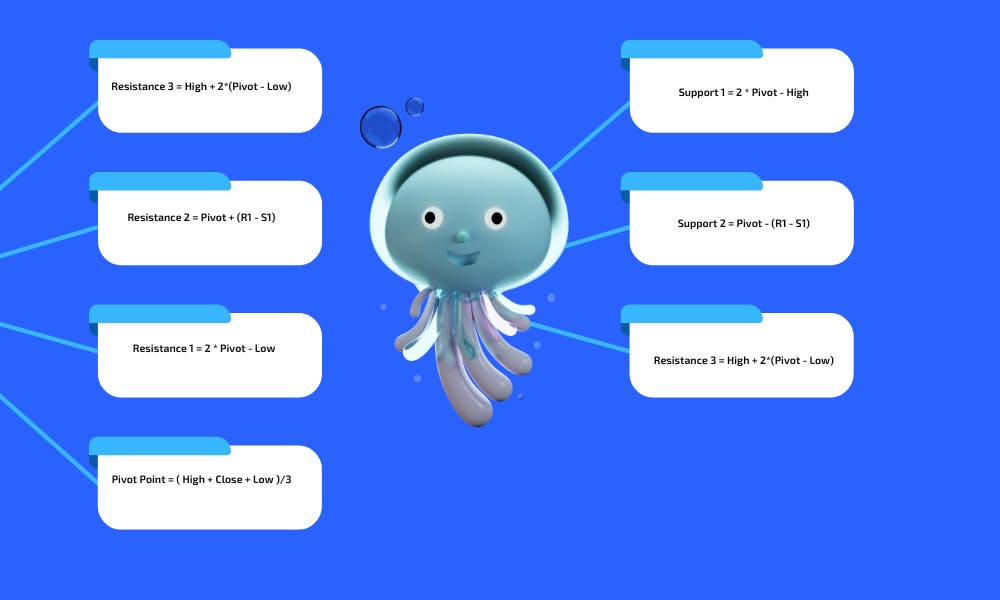

Assuming you like to ascertain the pivot points yourself, here are the recipes you want:

Resistance 3 = High + 2*(Pivot - Low)

Resistance 2 = Pivot + (R1 - S1)

Resistance 1 = 2 * Pivot - Low

Pivot Point = ( High + Close + Low )/3

Support 1 = 2 * Pivot - High

Support 2 = Pivot - (R1 - S1)

Support 3 = Low - 2*(High - Pivot)

As you can see from the above equations, by simply having the earlier day's high, low and close costs, you in the end up with 7 points: 3 obstruction levels, 3 help levels and the genuine pivot point.

In the event that the market opens over the pivot point, the predisposition for the day is long exchanges. On the off chance that the market opens beneath the pivot point, the predisposition for the day is short exchanges.

The three most significant pivot points are R1, S1 and the real pivot point.

The overall thought behind trading pivot points is to search for an inversion or break of R1 or S1. When the market arrives at R2 or R3, or S2 or S3, the market will as of now be overbought or oversold and these levels ought to be utilized as prompts to exit as opposed to enter.

An ideal arrangement would be for the market to open over the pivot level and afterward slow down somewhat at R1 then, at that point, happen to R2. You would enter on a break of R1 with an objective of R2 and in the event that the market was areas of strength for truly half at R2 and target R3 with the rest of your situation.

Sadly, things don't generally work out as expected we need to move toward each trading day all that can be expected. I have picked an irregular day from an earlier time, and what follows are a few thoughts on how you might have exchanged that day utilizing pivot points.

Trading with Pivot Points

Trading with Pivot Points At their core, Pivot Points serve as reference points that traders can use to judge changes in market sentiment.

If the prevailing market sentiment is expected to change or reverse, traders will apply the pivot points bounce strategy.

Pivot points can also be used to trade potential price breakouts in the market.

If a divergence happens at a pivot line, this is a strong confluence signal that implies the relevant support or resistance line will hold.

For instance, an RSI bearish divergence happening on R1 will prompt sell orders that will target PP, S1, S2, and S3 as profit targets, with stop losses placed above R2 and R3. When using Pivot Points, it is important to understand that support and resistance lines are action areas.